All Categories

Featured

Table of Contents

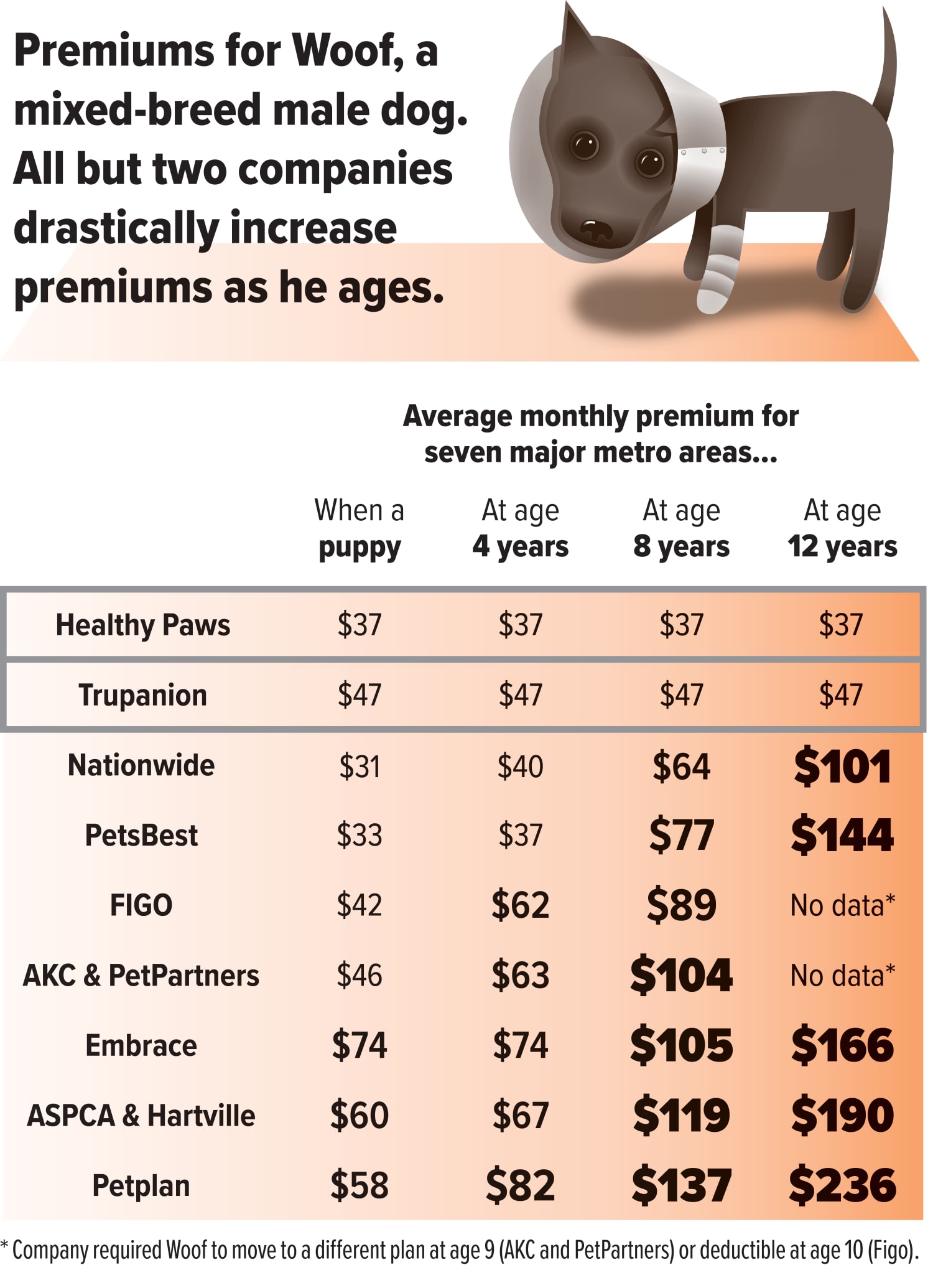

Similar to in human medication, you can maintain your costs reduced by selecting a high deductible, a lower repayment price or a reduced, coverage restriction. Given that the firm Vet Family pet Insurance policy (VPI) was formed in The golden state by a group ofveterinarians in the late 1970s several business have come and gone. VPI was gotten byNationwide numerous years back and is still among the leaders in the industry yet there are numerous trusted companies in the industry currently.

As vet medicine comes to be much more technologically progressed, the price of treatment rises. That's due to higher prices connected with the devices, centers and training called for to offer these higher-quality services (pet insurance). Animal health insurance policy can help by balancing out some or a lot of the expenses of diagnosing, treating and managing your family pet's disease or injury

Talk with your vet about it, and research your choices. AVMA's policy on pet wellness insurance coverage define numerous arrangements that are essential in insurance coverage. Here are some fundamental considerations: Despite the insurance coverage supplier, your veterinarian should be keeping track of the wellness of your animal as part of a veterinarian-client-patient connection. All charges, consisting of co-pays, deductibles, add-on fees and various other charges, should be plainly described to you so you totally recognize the policy and its restrictions. You need to be enabled to choose the veterinarian that will certainly look after your animal. Pet insurance policy plans are normally compensation plans you foot the bill in advance and are compensated by the insurance coverage carrier.

The 5-Minute Rule for Is Pet Insurance Worth It & How Does It Work? - Zoetis Petcare

If you're worried regarding covering the expenses up front, ask your vet regarding repayment choices that will certainly benefit you in case you require to make plans. It's ideal to understand your options beforehand so you do not have the added tension of trying to pay arrangements throughout an emergency.

There are consumer sites that compare features and prices of animal insurance policy, and/or offer reviews, and you may find these useful. The AVMA does not recommend or recommend any company over others.

The insurance coverage one type of policy offers might differ from one pet dog insurance company to the following, so pay close interest to the details when going shopping for an animal insurance plan. An accident-only plan will not cover elective surgical procedure to eliminate a growth, but it needs to cover veterinarian expenses for points like busted bones or lacerations (pet insurance).

The Are You Having Trouble Affording Your Pet? Ideas

If your goofball pup ingests a foreign object or something poisonous, your insurance firm will likely foot the resulting veterinarian costs. If you're on a budget plan, an accident-only strategy might be a great option for you and your family pets.

Here's a consider the type of problems these pet insurance policy policies do and don't cover. pet insurance. Caret Down Symbol Burns Attack wounds Bloat Broken toenails Broken bones Eye trauma Foreign matter or item intake Fractured teeth Drunkenness Lacerations Poisoning Torn cruciate ligaments Caret Down Icon Diseases (microbial or viral) Routine vet sees A crash and disease plan provides one of the most thorough animal insurance policy, covering both injuries and ailments

Consider a copayment as an "gain access to" cost that you pay to obtain your reimbursement.: This is the amount you need to pay out of pocket prior to your insurance coverage starts. The greater the deductible, the reduced your monthly costs, it's all regarding stabilizing what works for your spending plan.

Latest Posts

The Military & Veterans' Guide To Pet Health Insurance PDFs

About What Does Pet Insurance Cover? - Manypets

How What Does Pet Insurance Cover? can Save You Time, Stress, and Money.